can you go to jail for not paying taxes in canada

Tax evasion has a financial cost. If you owe tax debt and cannot pay the CRA can take strong collections action against you but it is not a crime and you cannot go to jail.

The Marvelous Rbc Bank Statement Psd Fill Online Printable Fillable Pertaining To Blank Bank Statem Statement Template Credit Card Statement Bank Statement

The potential penalties for tax evasion Canada can be very severe.

. In short tax avoidance is merely legitimate tax planning. In fact you may be able to come up with an alternative arrangement with the IRS. The reality is that owing money to the CRA is not illegal.

In 2016 the IRS launched nearly 3400 investigations related. It is a federal crime for which you can receive up to five years in prison for each offense of which you are convicted. It also wont protect you from criminal charges.

If you file your return but cant afford the tax bill you wont go to jail. Being convicted of tax evasion can also lead to fingerprinting court imposed fines jail time and a criminal record. Oftentimes youll be subject to tax penalties which will run you a pretty penny at up to 50 of your unpaid tax amount.

Yes but only in very specific situations. Section 238 of the Income Tax Act states the penalties for failing to file a tax return if youre required to do so. What Gets Taxpayers into Criminal Prosecution with the IRS.

Avoidance of tax is not a criminal offense. To better understand these distinctions lets take a closer look at when you risk jail time for failing to pay your taxes. However that doesnt mean that you cant face potential criminal charges for other tax situations.

Taxpayers can also go on a payment plan with the IRS to help pay off what they owe over time and depending on certain circumstances penalties and interest on taxes owed can be waived Cawley said. Making an honest mistake on. This may have you wondering can you go to jail for not paying taxes.

The IRS doesnt pursue many tax evasion cases for people who cant pay their taxes. The CRA convicted 128 people of tax evasion or tax fraud in fiscal year 2013 but only 29 of them or 23 per cent were sentenced to jail time. However you cant go to jail for not having enough money to pay your taxes.

You may even face wage garnishment or property seizure. The CRAs own statistics show that for any given year only around 100 Canadians are charged for criminal tax evasion or fraud. Criminal sanctions under Canadas Income Tax Act and Excise Tax Act include jail time and fines of up to 200 of the evasion amount if any.

1 day agoCan You Go To Jail For Unpaid Taxes In Canada. Jail for Not Paying Civil Fines or Criminal Justice Debt If you dont have the money to pay court costs or fines the outcome depends on your state of residence. If you file your tax return and it states that you owe taxes and do not pay them there is no criminal penalty.

You can go to jail for not filing your taxes. Tax evasion is defined as any action taken to evade the assessment of federal or state taxes. The fact is tax cheats in Canada only rarely go to jail.

If you owe taxes and do not file a tax return it is a crime. The CRA does not call or email taxpayers about going to jail to collect tax debts. It can take many forms including not reporting income claiming expenses for work not actually performed or owed or simply not paying taxes.

You cannot go to jail for not being able to pay but you can go to jail for ignoring the court. To better understand these distinctions take a closer look at when you risk jail time for failing to pay your taxes. Exceptions to the Rule.

Usually tax evasion cases on legal-source income start with an audit of the filed tax. You can be fined up to 25000 per year andor sentenced to one year in prison for each unfiled year. Filing a tax return that you know is not truthful is a felony and carries a prison term of greater than one year.

And of these approximately 100 individuals only around 25 receive a judgment that includes a prison sentence. The short answer is. This offence results in a fine of anywhere between 1000 and 25000 and up to one year in prison.

But if you conceal assets and income that you should use to pay your back taxes thats a different story. Whether youre cheating on your taxes here in Canada or hiding assets or money in foreign jurisdictions the consequences are serious. If you do not the Canada Revenue Agency CRA could potentially charge you with a crime which could.

Making an honest mistake on your tax return will not land you in prison. The first debt that you can indeed be prosecuted and put behind bars for is failure to pay taxes better known as tax evasion or in the words of the IRS tax fraud. If you are found guilty you could face a large fine and even potential criminal charges that could result in jail time.

Taxpayers have the right to reduce avoid or minimize their taxes by legitimate means. Failing to file a tax return is a misdemeanor punishable by imprisonment for up to one year in jail. Since tax evasion Canada is a very serious charge it is important that you file your taxes correctly.

However a lot of people wonder if you can go to jail for tax debt. You should be concerned about the possibility of a criminal investigation if. An exception to the above would be the case of outright fraud.

As mentioned earlier it is a common misconception that the Canada Revenue Agency will have you arrested for taxes owing. The average sentence in those cases was 22 months. What about tax debts.

Further if you are caught helping someone evade paying taxes you can also be arrested and charged with this crime. The short answer is maybe. One who avoids tax does not conceal or misrepresent but shapes and pre-plans events to reduce or eliminate tax liability within the parameters of the law.

Judging from the list of those imprisoned for running afoul of the CRA your evasion must be pretty egregious to land in the. Under our tax system Canadians can land in jail for a variety of tax offences but the chances of actually going to prison are very small and may become even more unlikely if the Canada Revenue Agency acts on its plan to cut auditors in 2015. Your unpaid taxes will be assessed penalties and also accrue interest though.

You can go to jail for lying on your tax return. You lied on your return to avoid paying taxes and now the CRA has notified you that they are reviewing it. Tax returns may result in jail time if not filed correctly.

But you cant go to jail for not having enough money to pay your taxes. If you are convicted of tax evasion failure to pay the criminal penalty will land you in jail. Absolutely yes you can go to jail for not paying your taxes.

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/xlmedia/L4GA4PV4RRBJ3M6WQEZOOBUUEU.jpg)

What Is Tax Evasion And How Can You Avoid It The Dough Roller

Downloadable Form W 9 What Is Irs Form W 9 Turbotax Tax Tips Videos Tax Forms Irs Forms Fillable Forms

Income Tax In Austria For Foreigners Academics Com

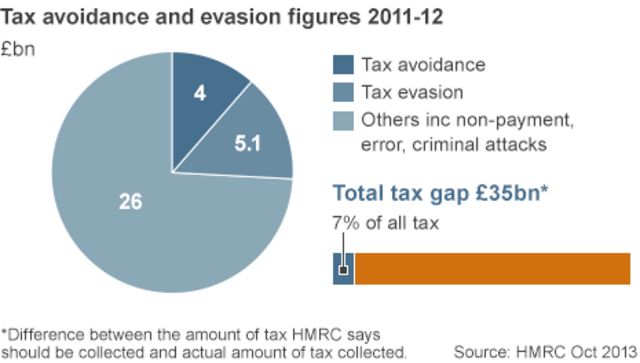

Tax Avoidance What Are The Rules Bbc News

5 Ways You Could Accidentally Commit Tax Fraud Huffpost Life

Sen Percy Downe Time To Go Hard On Overseas Tax Evasion Saltwire

What Happens If You Don T File Taxes Can You Go To Jail For Not Filing Taxes

Don T Pay Tax In Canada Visitor Ictsd Org

Oman Insurance Claim Form Uae How Oman Insurance Claim Form Uae Is Going To Change Your Busi Business Strategy Health Care Insurance Half Term Holidays

What Are Marriage Penalties And Bonuses Tax Policy Center

A Huge Benefit Of A Homebusiness And Networkmarketing Is The Tax Writeoffs You Receive Accounting Humor Taxes Humor Maxine

Professional Size Poker Marbleized Dominoes Set Of 54 Http Www Newtsgames Com Professional Size Poker Dominoes Html Dominoes Set Domino Marbleized

Ayn Rand Character Flow Chart Via Http Www Cracked Com Funny 304 Ayn Rand Ayn Rand Flow Chart Objectivism

Pancakeswap Guide Taxes And More Koinly

19 Tax Evasion Statistics You Shouldn T Evade In 2021 Spendmenot